Buyouts

Some neighborhoods have only two options: Build up or buyout

What’s the problem?

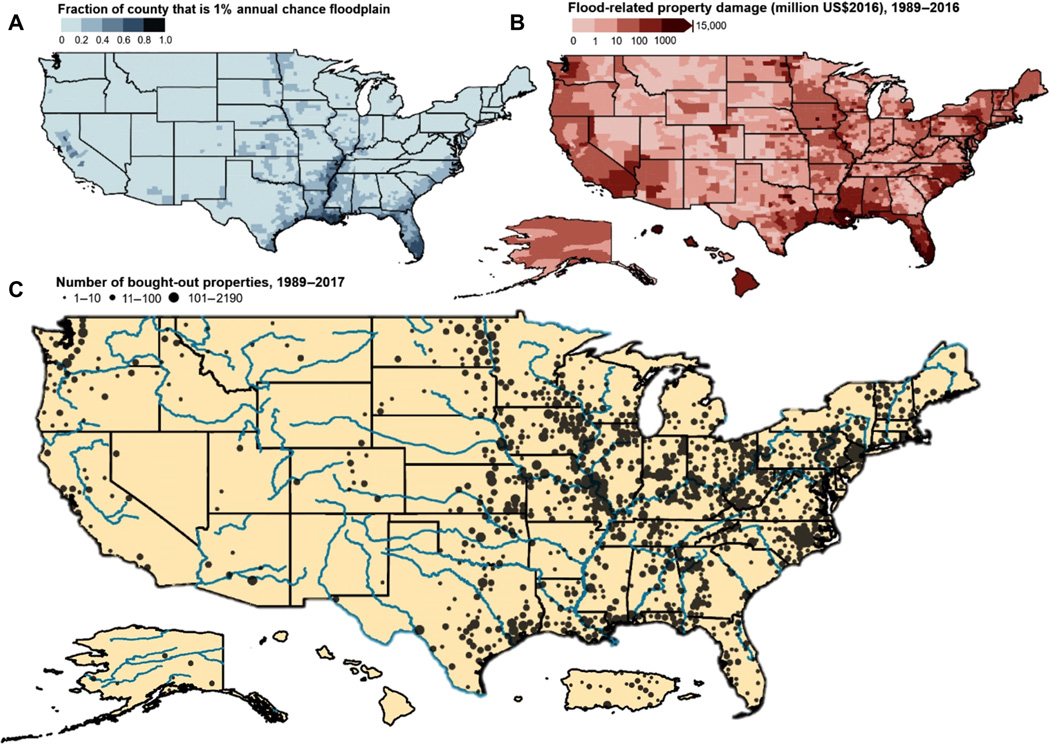

Thousands of homes across the United States face the same problem: They were built in floodplains, and now it’s impossible or financially unreasonable to protect them from flooding. Some of these homes were built so long ago that we didn’t know where the floodplains were yet. But as it’s flooded, again and again, we now see that they’re very much at risk. Other homes were built improperly – builders knew they were at risk, but they built them anyway, and local governments didn’t stop them. Last are the homes that were built outside of the floodplain, at least according to FEMA.

Where are FEMA’s flood risk models different from updated maps?

FEMA’s maps are wrong

But here’s the rub for that last – and largest – group of homes. FEMA’s maps are wrong. The floodplain maps the federal government creates to help communities prevent development in risky areas leave out all kinds of major risks – things like flooding driven by rainfall, problems other landowners create that make drainage worse, and rising sea levels.1

Taxpayers are covering the bill

Neighborhoods like these create challenges for both their own residents and for residents in other parts of the county. Neighborhood residents are stuck in homes that flood again and again, which they then have to repair at a loss and are difficult to sell. And other county residents – the taxpayers – have to help pay for repairs to those flood-prone homes and the county resources to rescue people from them during flood events (think firefighters in boats).

What’s the solution?

Buyouts

Well, one is to elevate – to raise the homes above flood level. But that’s extremely expensive, requires lots of maintenance, is inconvenient for homeowners, and radically changes the feel of the neighborhood. Not ideal. The other option, which has been used to address flooding in more than 40,000 US homes in the last 4 decades, are buyouts. 2

Protecting your investment

Buyouts provide homeowners in flood-prone areas with a voluntary opportunity to sell to the local government at fair market value. They can use proceeds from the sale to move to a place that’s less flood-prone, and the local government removes the house and converts the lot to open space. That open space makes more room for water when it floods, helping to protect the rest of the community.

What’s the catch?

Sounds great, right? Here’s the problem: Buyouts today are slow, inflexible, and reactive. First, the average home buyout in the US takes more than 5 years, as local officials try to work with federal agencies like FEMA and HUD to raise funds and jump through bureaucratic hoops3. This leaves homeowners in the lurch, unsure whether to repair, sell for a loss, or live in a badly damaged house for years at a time. Second, buyout funding from the federal government can only be used under very specific circumstances. Homes have to be in the floodplain as shown on the (inaccurate) federal maps, and local governments have to put up 25% of the money for the purchases. Last, almost all federal funding for buyouts comes after a disaster, not before. Communities need that money before the disaster, to prevent disasters before they happen.

Buyouts are often the right solution. But the way they’re set up today isn’t working. What’s the fix? Local governments should fund buyouts directly. Then, buyouts can move faster and can be implemented before the next disaster strikes, not after.

It’s been done before

Several cities and counties across the US have demonstrated how big a difference local buyout funding can make. In Charlotte-Mecklenburg County, NC, the county has purchased more than 400 flood-prone houses, apartment buildings, and businesses. That allowed 700 families and businesses to move to less vulnerable locations, opened up 185 acres of public space, and avoided $25 million in losses that would have fallen on county taxpayers. The county expects long-term savings for taxpayers of more than $300 million.4 On an even larger scale, Harris County, TX has combined local and federal funding to purchase more than 2,500 flood-prone structures since 1985. That’s opened up 1,300 acres and gotten thousands of families out of harm’s way.5

What does this mean for your county?

If your neighborhood has flooded again and again and it seems nearly impossible to protect it, it may need a buyout. Already asked for one and the county hasn’t been able to help? There are three ways for the county to raise that money: stormwater fees, local option sales taxes, and development impact fees. Stormwater fees charge property owners a small amount of money every year to support flood protection. Local options sales taxes add a small (typically 1% or 0.5%) surcharge to everyday purchases. And development impact fees charge the owners of new buildings a small fee to offset the cost of addressing their drainage needs.

Three Funding Sources

Your county can use some or all of these approaches to raise money for flood protection and can dedicate all or a portion of it to buyouts. If they do this well, they can leverage those funds into even more dollars for flood protection. That’s how a county moves the needle and a proposed buyout becomes a real solution for flood-prone homeowners.

Learn More About Funding