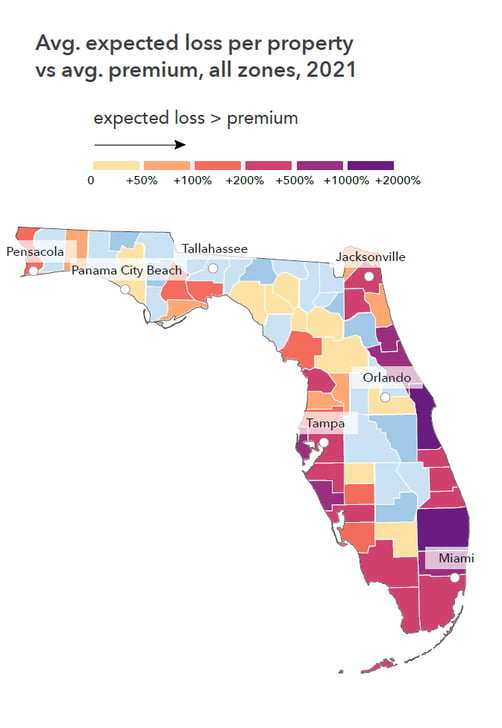

FEMA is implementing a new pricing model for the National Flood Insurance Program (NFIP) called Risk Rating 2.0. Risk Rating 2.0 will set new premiums for properties both inside and outside of Special Flood Hazard Areas (SFHA) based on their individual flood risk.

Why it matters: When Risk Rating 2.0 comes out, the First Street Foundation, a nonprofit research organization dedicated to analyzing flood risk, predicts that flood insurance rates will increase greatly in states like Florida.

Go deeper: FEMA is making a conscious effort to make sure that insurance costs more accurately reflect today’s flood risk.

Currently, 906,465 homes in Florida have substantial flood risk but fall outside of an SFHA, and are not required to have flood insurance, according to First Street Foundation.

-

The average annual loss for these properties is estimated to be $8,788 this year.

-

Another 1.5 million Florida homes in SFHA, and with flood insurance, would see a premium increase of 440%, to $8,276 a year.

Our thought bubble: “Quantifying flood risk in economic terms creates a new context for homeowners to understand their risk, and for buyers to consider when evaluating a property,” said Matthew Eby, Executive Director of First Street Foundation. “We’re providing key insights into how flooding can impact the financial bottom line of property owners along with solutions that can protect their largest investment.”